What is a trust?

Trusts are most commonly used by wealthy individuals or for commercial or charitable purposes and in this article, we refer only to those for private wealth.

A ‘trust’, usually referred to in legislation as a ‘settlement’, is a legal relationship created by a ‘settlor’, during lifetime or on death (e.g. contained in their Will), when the settlor places assets (e.g. money, shares, property) under the control of one or more ‘trustees’, who must hold those assets for the benefit of ‘beneficiaries’ (the person/s that the settlor intends to benefit from the trust).

Trusts are normally irrevocable, which means that the settlor cannot legally demand the trustees to return the assets, unless the trust document either expressly states that it is revocable or the settlor is a beneficiary.

The key characteristics of a trust

- The separation of the ‘legal ownership’ of an asset and a ‘beneficial interest’ in the same asset (the trustees become the ‘legal’ owners of the assets in the trust and the ‘beneficiaries’ become the ‘beneficial’ owners).

- The settlor cannot hold assets as a sole trustee if they are also the sole beneficiary.

- If the settlor retains too much control of the trust assets, the trust may be deemed as a ‘sham’ and therefore be declared invalid by a Court.

- The trust assets are a separate fund and are not a part of the trustee’s own assets.

- The beneficiaries have rights to enforce the obligations of the trustees to manage the assets in the interests of the beneficiaries.

- The trustees have the ‘powers’ and ‘duties’ (for which they are accountable to the beneficiaries) to manage and dispose of the assets according to the terms of the trust document and their statutory duties.

The requirements to create a trust

- The settlor must actually intend to create a trust (except for ‘statutory’ and ‘common law’ trusts).

- The beneficiaries of the trust must be identifiable.

- There must be certainty about what is to be held in the trust. For example it must be possible to identify what assets have been transferred to the trustees to hold under the terms of the trust.

Types of trust

Generally, trusts can be created:-

- Intentionally by the settlor (an ‘express trust’).

- By statute (a ‘statutory trust’).

- By operation of ‘common law’ (a ‘constructive trust’ or ‘resulting trust’).

Express trusts

Express trusts are intentionally created on the terms set out in the trust document. The four main categories of express trusts are ‘bare trusts’, ‘interest in possession (IIP) trusts’, ‘discretionary trusts’ and ‘contingent trusts’.

Statutory trusts

A statutory trust is a trust imposed by ‘statute’ (an Act of Parliament) in specific circumstances and comes into being automatically, when an event or circumstance as set out in the relevant legislation occurs. Two common examples are:-

- The ‘Intestacy Rules’ that apply to a person’s assets if they die leaving no Will; and

- ‘Trusts of land’, which are created when two or more people are the beneficial owners of land.

Trusts imposed by operation of law (‘common law trusts’)

The two types of trust imposed by operation of law are ‘resulting trusts’ (where a trust fails and the assets revert back to the settlor) and ‘constructive trusts’ (which are imposed on persons knowing that they are not entitled to the trust assets and/or persons dishonestly helping trustees to deal with trust property in a way that is inconsistent with it being trust property).

Conclusion

Trusts law is often complex and so legal advice should be sought early in any trusts matter to avoid confusion and unintended consequences.

We will expand on many aspects of trusts and trusts law in future articles, so please regularly visit our website for more information.

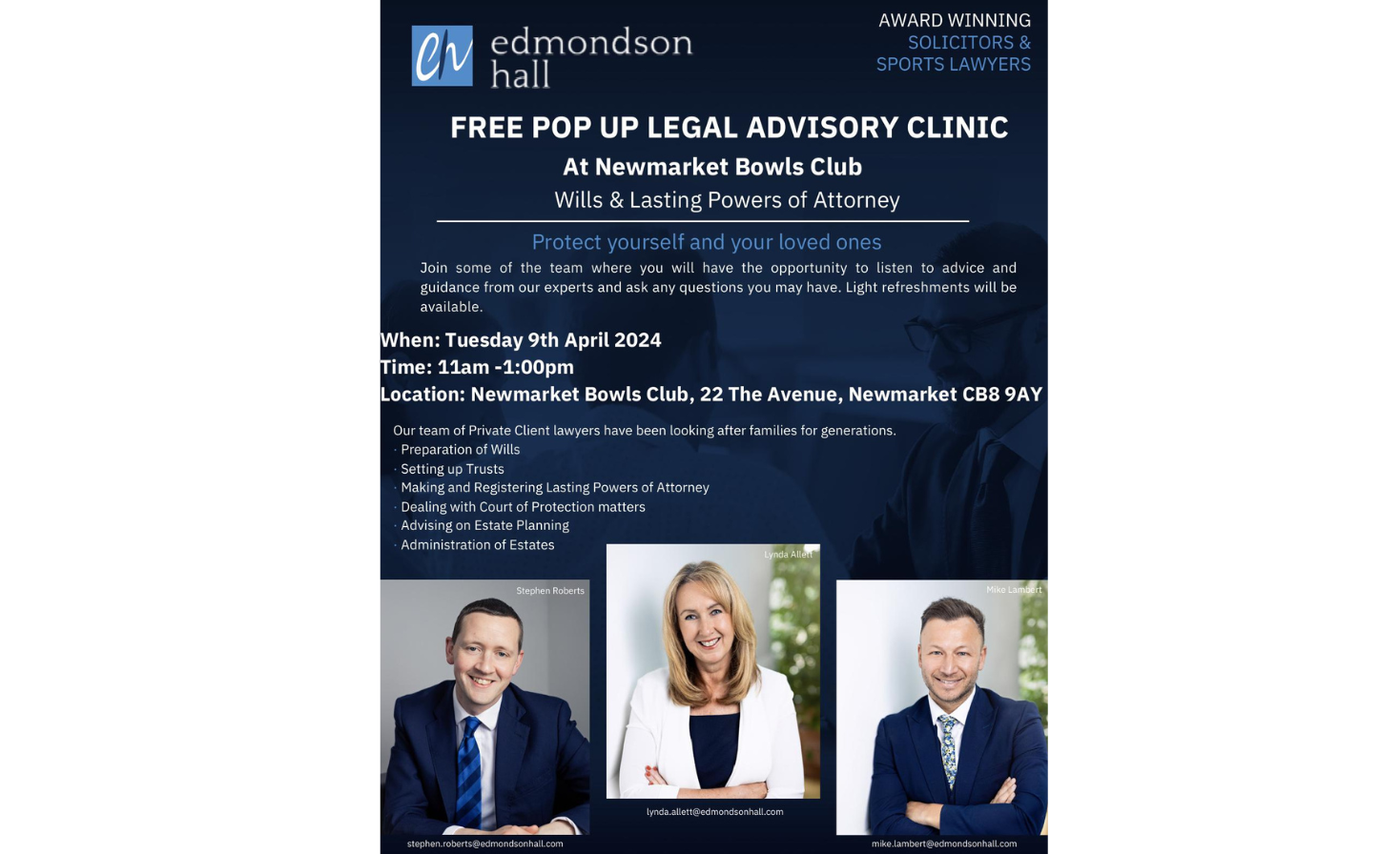

Article written by Private Client Solicitor Stephen Roberts. To make an appointment or for more information please telephone 01638 560556 or email stephen.roberts@edmondsonhall.com