What is a ‘cross-border estate’?

A situation in which someone who has died owns money, property/land and/or other investments (referred to as ‘assets’ in this article) both in and outside of England and Wales (which is one legal jurisdiction within the UK, commonly referred to as ‘English Law’).

The key characteristics of a cross-border estate

- ‘Domicile’: in English Law, the concept of domicile determines which legal jurisdiction shall apply its laws to the deceased person’s estate. Sometimes, more than one jurisdiction applies its own laws.

- ‘Conflict of laws’: if more than one jurisdiction wants to apply its laws to the deceased’s assets, sometimes they conflict and so in such circumstances a system of ‘Private International Law’ attempts to achieve clarity.

- Wills: most jurisdictions recognise the ability for someone to record their wishes in a formal legal document that shall be effective on their death to distribute their assets in accordance with their wishes, however, many jurisdictions impose requirements for recognising a Will not made in accordance with their own laws.

- Tax: most jurisdictions either levy Inheritance Tax or a similar type of tax, often referred to as ‘Stamp Duty’, on the assets in a deceased person’s estate. It is very common for each jurisdiction to levy tax on the assets that the deceased person owned in its own jurisdiction.

Domicile

In English Law, establishing the deceased’s domicile is crucial before being able to proceed with the administration of the estate, as it determines which jurisdiction/s shall apply their tax (i.e. Inheritance Tax or similar) and succession laws to the deceased’s assets (i.e. who inherits the assets).

Domicile in English Law is established either by the deceased person meeting the ‘actual domiciled test’, which is essentially where they had their last known permanent residence, or the ‘deemed domiciled test’, which is more complex, as it is based upon detailed statutory criteria. The deceased has to fail both tests to be considered as domiciled abroad.

It is possible for the deceased to be considered as domiciled in different jurisdictions for different taxes.

Conflict of laws

In English Law, if the deceased is considered as domiciled in England & Wales, then English Law shall apply to all of their ‘moveable’ assets (e.g. bank accounts) worldwide, assuming that the Courts of the other relevant jurisdiction/s agree, but only to their ‘immoveable’ assets in England & Wales, therefore deferring to the laws of the other relevant jurisdiction/s for such assets situated abroad, unless the Courts of such jurisdiction/s allow English Law to apply instead.

Some jurisdictions, particularly most of those that are members of the European Union, allow the deceased to make a ‘choice of law’ in their Will, which obliges such jurisdictions to apply the succession laws (but not necessarily tax laws) of the deceased’s nationality to the succession of the deceased’s assets, rather than that jurisdiction’s own succession laws. In circumstances such as, for example, the deceased being domiciled in England and Wales at their death, also being a UK national, but owning a holiday home in France, by the deceased including a choice of law clause in their Will, English Law (rather than French succession laws) could apply to that holiday home, despite it being immoveable property situated abroad.

Wills

In English Law, a Will made outside of England and Wales is recognised as being valid if, at the time it was made, it complied with the laws of the jurisdiction in which it was made, for which the High Court would require evidence of such due execution.

It is therefore possible in English Law for the terms of a deceased person’s Will made outside of England and Wales to apply to the succession of their assets in England and Wales, but the succession laws of the jurisdiction in which it was made cannot apply instead.

Tax

In English Law, if the deceased is considered as domiciled in the UK, then UK Inheritance Tax shall be levied on the deceased’s worldwide assets. If they are considered as domiciled abroad however, then UK Inheritance Tax shall only apply to their assets situated in the UK (which is usually only considered to be immoveable assets).

If the deceased’s assets are subjected to Inheritance Tax (or tax of a similar type) in more than one jurisdiction, then relief from double taxation can usually be obtained either pursuant to a tax treaty between the UK and the other jurisdiction/s or otherwise from UK HMRC as ‘unilateral relief’.

Conclusion

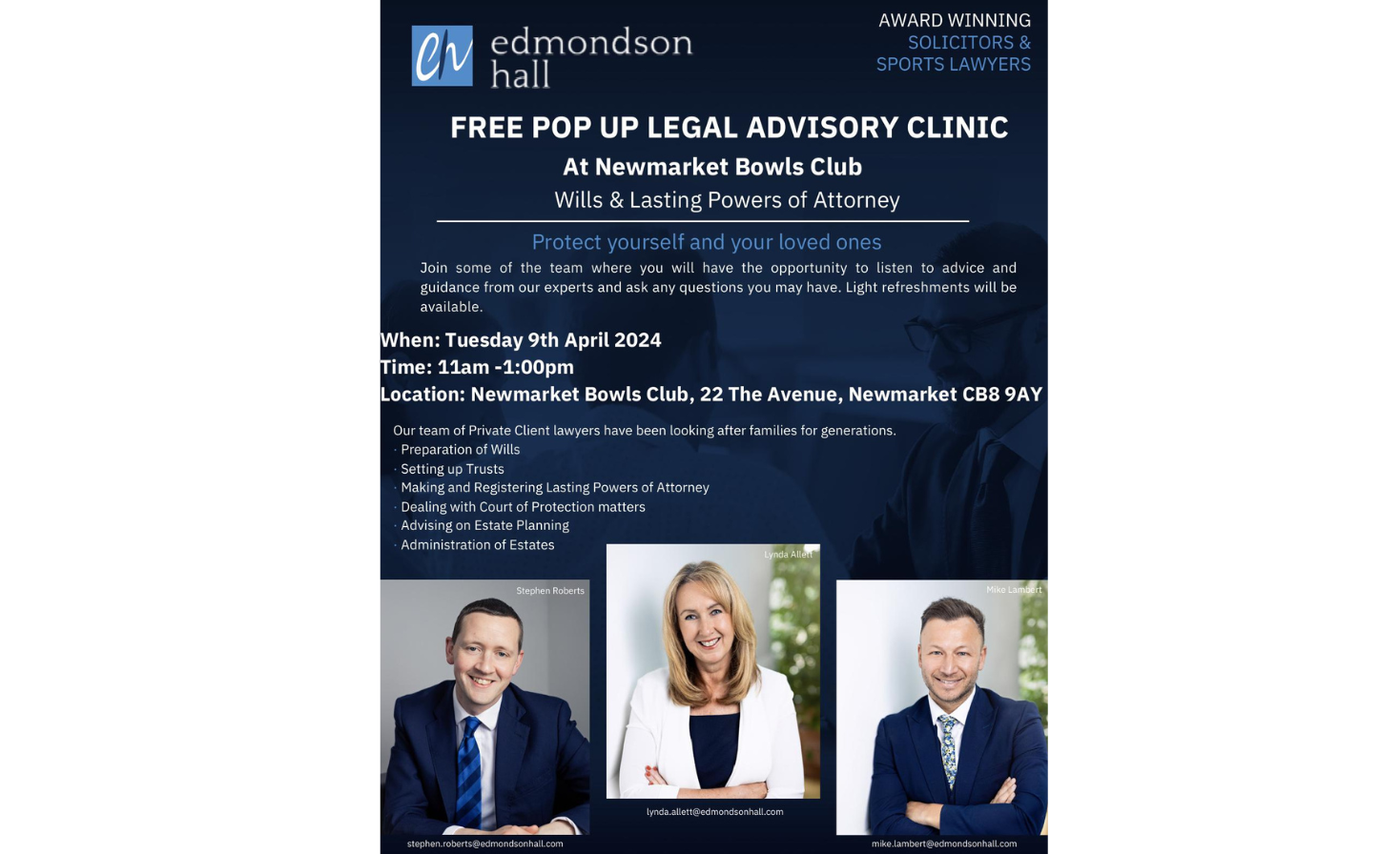

Cross-border estates are clearly complex and so legal advice should be sought early in such a scenario, often from lawyers in more than one jurisdiction. We are experienced in administering cross-border estates with assistance from contacts that we have established abroad in previous matters, so please do not hesitate to contact us if you require assistance.

Article written by Stephen Roberts – Private Client Solicitor & Head of Data Management

To make an appointment or for more information please telephone 01638 560556 or email stephen.roberts@edmondsonhall.com .